Americans for Tax Reform

Posted on | July 16, 2011 | 1 Comment

As many of you know Congress does some serious work from time to time. Then there is the Roger Clemen’s perjury case. He was on trial for lying to Congress over use of performance-enhancing drugs. At his trial, I read that the prosecution team (Steven Durham and Daniel Butler) were building a very solid case up until when they dropped the ball. Now that the Clemens trial has ended in mistrial, I’d like Congress to actually resolve the debt ceiling problem.

I think general population is starting to realize that the debt ceiling is a pretty big deal and could have some harmful consequences (Although, I think we should default on China anyway. I hate having to buy low quality stuff made in China and having them use the proceeds to buy our debt and then having to pay them interest on it. It just doesn’t seem right. Especially, now that China is whining about it.). Some Republicans seem to be using a pledge they signed that expressed commitment to not raise taxes as a scapegoat (example below).

As I was researching the tax pledge, the name Grover Norquist came to my attention. He is the founder and current president of Americans for Tax Reform. Naturally, I went to Wikipedia and Google to find out more about this person. You can read his profile on wikipedia here. A few things struck me about his profile. First, he doesn’t seem to be in touch with the common man. His profile on Wikipedia says he grew up wealthy, then went to Harvard for his undergrad and graduate studies. So his home life and his undergraduate years at Harvard shaped his politcal views because he’s been quoted as saying “When I became 21, I decided that nobody learned anything about politics after the age of 21. (quote was taken from the wikipedia listing)” Secondly, I’m not sure how he made his money. I like to here about people that started with nothing or very little, worked hard and prospered. The only thing I see listed for Mr. Norquist is that he only works part-time at ATR and in 2009 received $200,000 in annual compensation plus additional compensation that he receives from other boards he sits on. Third, it strikes me a bit odd that he profits from operating an organization that takes donations (giving donors tax breaks), reducing government receipts (by over $3,800,000 in 2009 — this is a tiny sum compared to overall government receipts) therefore further exacerbating the need for debt ceiling relief. This is ingenious! So this guy and his Republican cohorts are holding the American people hostage.

Play Budget Hero

Posted on | July 14, 2011 | No Comments

Like a lot of concerned citizens, I’ve been monitoring intently the developments (or lack thereof) of the debt ceiling talks going on in Washington. I was amused to hear that Cantor, the only Jewish Republican currently serving in Congress, had disrespected the black President during the meeting. Cantor later issued an apology.

On my way home from work I heard American Public Media mention that they had created a Budget Hero game so that one could solve the debt crisis. I thought it was pretty cool so I went ahead and tried it. You can try for yourself below. Have fun!

Selfless Jeter Fan

Posted on | July 13, 2011 | No Comments

By now everyone has heard of Christian Lopez. He is the 23 year old Yankee fan that caught Derek Jeter’s home run ball that also happened to be his 3000 hit! When I first heard about it, I was surprised at how selfless he was to just give back the ball. He did get some nice gifts in exchange: luxury seats for the remainder of the season and autographed memorabilia. I have to admit that I might have initially done the same figuring it was the right thing to do. Now, it appears that he is getting some financial assistance to offset the tax implications. After thinking about Christian’s situation for a couple of days. I think he could have worked out a better deal. Look at the deal Steiner sports worked out. Heck, the are even planning on digging up dirt and selling it to fans. The gifts are nice but if I were him, I would have asked to get my student loans repaid. He has over 100k in debt! I hope he is able to pay down his debt with the donations he receives.

Girlfriend Main Suspect in Millionaire’s Death

Posted on | July 8, 2011 | No Comments

Ronald Charles Vinci is believed to have been murdered at the age of 70 by his longtime girlfriend. According to the report I read, he made his wealth selling cars. He started and eventually sold the Pacific Honda Dealership in southern California. I’m sure he worked hard (as did his employees) and earned every cent he made. I’m sure he lived a very good life too. What more can you ask for?

The interesting tidbit from the report was that he purchased a home in 2006 in Rancho Santa Fe (a very posh enclave in San Diego county, I believe Bill Gates has a home there too!) and has a grown son living there. It must be nice to have one’s biggest expense paid for! Mr. Vinci owned other real estate as well in Florida including the mansion he lived in. I would be very surprised if money wasn’t set aside for him to be able to continue paying property taxes on the 1.2 million dollar home too.

I have to give a shout out to our Congress for enabling the transfer of wealth. Through 2012, a 5 million dollar exemption applies per individual. Even more wealth can be transferred with insurance, charities and trusts. It just depends on how “creative” the individual wants to be.

Where to Call Home in Retirement

Posted on | July 6, 2011 | 1 Comment

I found an article on www.Kiplinger.com today titled: “8 Great Places to Retire Abroad.” The author, Donna Fuscaldo, recommended several places I had not considered. I need to get out more and travel! I don’t think I would retire in Mexico right now but in 30 years a lot could change. I’d definitely consider Italy, Belize and Panama. The other places mentioned, I’d have to at least visit first before making a decision. Anyway, I have a long ways to go before I can even consider retiring.

Another Dividend Growth Proponent

Posted on | July 5, 2011 | No Comments

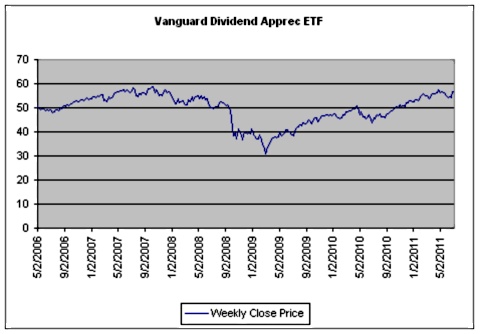

Last month, I wrote a post on starting a dividend growth portfolio. I came across another writer who also advocates in favor of investing in growing dividends. You can find his article here. He focuses in on two Vanguard funds (Vanguard Dividend Growth fund (VDIGX) and Vanguard Dividend Appreciation ETF (VIG). Interestingly enough, he mentions the Vanguard Dividend Appreciation ETF (VIG) as the better option. I agree with him too.

The VIG tracks the Dividend Achievers Select Index — which comprises of companies that have raised dividends for the last ten years and seem poised to continue to do so. I started to research the fund and found some great companies including: International Business Machines (IBM) and Microsoft (MSFT), ExxonMobil (XOM), Pfizer (PFE), Johnson & Johnson (JNJ), and Target (TGT).

You’ll notice that it is almost at the peak. Although it probably contains stocks that are undervalued right now I think overall it is too expensive. I’m going to wait for it come down in price before I purchase some shares.

Full Disclosure: I own stock in Microsoft.

Market is up This Week!

Posted on | July 1, 2011 | No Comments

The stock market ended up this week. I think it was a rouse to get everyone to enjoy their weekend. I’m not complaining though. Both the Dow and S&P 500 surged over 5% this week. I knew I should have bought some more stock last week. My biggest gain this week was in Visa (V). The debit fees were capped by the Fed at 21 cents a transaction. This caused V to climb 15% in a single trading day. I think it has given back some of the gains but I’ll take it! I keep reminding myself though that although the stock is up this week, I really would prefer for them to increase their dividend! I own about 25 shares so I think I’ll cash some of the shares next week if the price is right and cover my initial investment. I’ll keep the remaining shares forever!

Have a great 4th of July!

Debt Ceiling Chicanery

Posted on | June 27, 2011 | No Comments

How much does the US owe? You can see it here in real time: http://www.usdebtclock.org/. The page is very busy but the US owes almost 14.5 trillion and has almost maxed out the debt subject to the 14.3 trillion dollar limit.

The GOP [Republicans] say they won’t increase the limit without spending cuts to Medicare and Social Security. You can follow the stories here: http://money.cnn.com/news/specials/debt-crisis/ .

Over the weekend, I saw that AARP is starting to mobilize. I really like this commercial:

I think we should simplify the tax code and remove some tax entitlements. I see the entitlements as government spending because it allows for people to spend the government’s tax revenue that would otherwise be collected. Here is graphic from the Tax Policy Center Urban Institute and Brookings Institution.

A more detailed description is included here on their web site.

Walking Away From Your Mortgage and Home

Posted on | June 26, 2011 | No Comments

Ali and Christine were picking on Jeff in the video below for making the decision to stop paying his mortgages and letting the banks take back his properties. You can see the full interview below and a follow up story here:

I’ve included bits of the transcript for analysis:

VELSHI: OK, one in four homeowners are under water that means they owe more on their mortgage than their actual home is worth. Most of those people Christine are going to continue to live in their home and pay their mortgage.

ROMANS: Absolutely. For them they’re going to stay in that home and they know that over 10 or 15 or even 20 years, they’re actually going to recoup that investment.

I wish the media would stop referring to a primary home as an “investment.” That is so 2005. Now, we realize it is a liability. How do you recoup all the money in interest you’ve paid to the banks? For the majority of home owners that money is lost forever. The same goes for any repairs and property taxes you pay while “owning” your home.

VELSHI: Jeff, help me understand this, I go to Best Buy, I buy a TV, I put it on credit, but I was the first guy to buy that new TV and six months later, it’s selling for a lot less money then I paid for it. I can’t stop paying the bill if I had monthly payments on it so why can you stop paying your mortgage, because the value of the house has gone down?

Comparing buying a house with a mortgage with buying a tv? Really? We know what will happen if you stop paying your credit card bill. Eventually, it will be charged off and sent to collections. They’ll keep calling incessantly and then they’ll either write it off and send you a 1099-c or attempt to collect using our court system. If you are lucky you won’t be pursued: Lender Drops Pursuit of Debt.

VELSHI: Why is their problem? You made a decision to buy a house at a certain price, we all make decisions, sometimes we make, sometimes we loose. Why is it the banks problem because you doing that means that I have a harder time getting a mortgage?

During the crisis, banks were the only ones that knew how the prices were being justified. They knew the data that was being used to justify the prices. As a individual, Jeff had no idea how or what numbers were being used by fellow homeowners that allowed the prices to be bid up. Banks however have that information. They factored in the risk to the interest rate and issued the loan. In fact, the really sophisticated banks then packaged the loans and then bet against them. I believe that when a bank issues a letter rejecting a loan modification stating “it is not in the investors best interest,” I’d be willing to bet that that means that the same investor has a bet that pays out if the mortgage goes into foreclosure. So the investor gets the interest while the loan is performing and then a payoff when it inevitably goes to foreclosure.

I still believe the real solution was to allow all homeowners refinance their mortgages. I think it is also a good time to revisit the mortgage interest deduction that encourages homeowners to take on more debt! Let’s get rid of it and encourage homeowners to only commit to paying 25% of their income on housing. Of course they can pay extra if they want and pay off their mortgage sooner. Let’s encourage home ownership not home mortgages!

Follow this link to view a video regarding the strategic default of the Mortgage Brokers Association.

Over $120 Billion Missing

Posted on | June 17, 2011 | No Comments

I don’t know how a country can lose track of a $120 Billion dollars but China has managed to do it. You can read the story here. It appears that the money was laundered by officials that then fled the country. Gee how is the us can stop drug money coming in to the United State but can’t detect these transactions? What bothers me most about this story is that I would be willing to bet that some of these ill-gotten gains have impacted real estate prices here in the United States causing regular middle class citizens to take on more debt than they needed to to purchase their home. Thanks China!