More Millionaires in the Bay Area Means Higher Real Estate Prices

Posted on | June 15, 2011 | No Comments

I’ve become accustomed to checking wikinvest every morning. I checked the balance and found that I was down $1927.22 not including my 401(k). The stock market is down about 1.5% this morning across the board. Every stock I own is down today. So, I checked the business news on Bloomberg’s web site to find the cause.

It looks like the drop was caused by a negative report on Manufacturing.

But the second headline that caught my attention was: “Home Prices Exploding in Silicon Valley Amid More Millionaires”

A tech investor expects an explosion of newly minted millionaires due to companies beginning to trade publicly:

“You will probably see hundreds, if not thousands, of newly minted millionaires in the next two or three years,” said Steve Eskenazi, a tech investor in Hillsborough, north of Palo Alto, where the minimum lot size is a half acre (0.2 hectare). He sold his portion of an online advertising network to Sunnyvale-based Yahoo! Inc. in 2007.

This will drive up real estate prices up to 15 miles from the companies’ headquarters:

As more firms go public and workers cash in shares, real estate within 15 miles of the office will climb, said Rosen, who gave a presentation at Google Inc. (GOOG)’s Mountain View headquarters before the company’s 2004 IPO to educate employees on housing. Sales are usually concentrated in the “middle to upper end,” he said.

In Cupertino, about 12 miles from Palo Alto, a three- bedroom home listed for $908,000 got more than a dozen offers and sold for $950,000 on June 8, said Albert Kao, an agent at Giant Realty Inc. in the city. The prior owner, who bought the property in 2002, decided to sell after her children graduated from the public schools. She made a $290,000 profit before commissions, Kao said.

As insiders start to sell stock, real estate prices will be driven higher. This has already started in the case of Facebook:

Facebook founder Mark Zuckerberg, 27, bought a house this year in Palo Alto, said Larry Yu, a company spokesman. He declined to disclose details. Zuckerberg paid $7 million for a 5,000-square-foot (465-square-meter), seven-bedroom home in a “leafy and affluent” neighborhood, the San Jose Mercury News reported May 5, without saying where it got the information.

The purchase was made before Facebook’s scheduled move to Menlo Park, just north of Palo Alto.

The same way Google’s IPO has already pushed up prices the new IPOs will cause the trend to continue. The LinkedIn ipo is raising home prices in Mountain View and Facebook is expected to do the same in Palo Alto when they go public as early next year. Zynga, which is headquartered in San Francisco, is preparing for their IPO. Meanwhile, across the bay in Oakland, Pandora just started trading publicly today. So the whole bay area seems to be blanketed with soon to be millionaires.

If there is any solace to be gained from this trend it is that they will only cause a spike in housing at the high-end of the market. However, it is the Bay Area. Is it even possible to buy a detached home if you aren’t already a millionaire?

Luckily, for me, the stock market rebounded a little toward the end of the trading day. I finished the day down but only $1775.25.

Man’s Best Friend

Posted on | June 12, 2011 | No Comments

I definitely don’t need one of these now but I totally understand the appeal though. I suppose that if I had enough wealth I would enjoy the added protection that these dogs would provide. Especially, if I lived in a more private setting. I’ve always been fascinated by German Shepherds. They seem like a practical choice if you are in the market for a dog. They are obedient and protective.

You can read about Julia — The Executive Protection Dog on the New York Times site. Julia’s price was $230,000. The normal price for one these dogs is between 40k and 60k. It sounds like Julia was just a very special dog. For the well-heeled, I suppose it is money well spent.

I’ll just add this to my wish list once I have more money than I know what to do with.

Investing for Income

Posted on | June 8, 2011 | No Comments

The CNN Money web site had an article today regarding investing for income. You can read the full article here: Invest for Income: How to do it now.

The article recommends finding stocks that although have a modest dividend now, have the ability to boost their dividends in the future. The article references a study completed by Edward Jones that found that on a total return basis shares in the S&P 500 with the highest yields between 1972 and 2010 actually lost money for investors (.03%). While shares of stocks that were dividend growers actually actually returned 9.6% during that same period.

In the article, you’ll find multiple funds and several stocks that the author recommends when building out a dividend portfolio. Some of the funds focus on companies that have continuously raised dividends for 25 years [SPDR S&P Dividend (SDY)]. Another fund focuses on companies that have raised dividends for the last 10 years [Vanguard Dividend Appreciation (VIG)]. The author also recommends an international fund with a similar philosophy [Thornburg Investment Income Builder (TIBAX)]. Although this last fund also holds bonds.

It seems owning these or similar funds could form a nice core to a portfolio and could be augmented with individual stocks.

I don’t currently own any of the funds listed above. However, I do own Microsoft (MSFT) which was listed as an individual stock to consider.

Apple’s New Home

Posted on | June 7, 2011 | No Comments

I keep hearing that California is bad for business. I’m so glad that doesn’t apply to Apple. I’m grateful that Apple has decided to keep their HQ in California because we desperately need their tax revenue. The 54 thousand residents in Cupertino should also be thankful. In case you haven’t heard, Apple is planning on expanding their headquarters and would like to stay in Cupertino. I’ve included the video below of Steve Jobs presenting his vision to the Cupertino city council.

I really like his vision for the new office. Besides the cool looking building, I’m excited about the apricot trees they’ll be planting! You can follow the progress here: http://www.cupertino.org/index.aspx?recordid=463&page=26

Keep up the good work Apple!

Bob Rodriguez

Posted on | June 6, 2011 | No Comments

I keep a list of people that I’d like to meet one day. I’m adding Bob Rodriguez to that list. I read about him on the CNNMoney and Fortune web site here. Mr. Rodriguez has achieved tremendous success as a money manager.

Rodriguez, the CEO of $16 billion money management firm First Pacific Advisors, isn’t the type to be satisfied with being right (though he’s certainly not above that particular pleasure). He’s seemingly compelled to share the hard truth. It’s as if he has this terrible gift, and with that comes the obligation to tell the world when calamity is on the horizon.

His resistance to investing vogues has paid off richly over the long run: His stock fund, FPA Capital (FPPTX), has returned 15% annually over the past 25 years, beating every single diversified equity fund, according to Lipper. His bond fund, FPA New Income (FPNIX), has never posted an annual loss. “He’d rather lose his clients than position their money in a way that he feels is inappropriate,” says Stephanie Pomboy, head of institutional research firm MacroMavens. “It’s almost sad that you can count the number of people who are willing to do that on, probably, one finger.”

I was further impressed by his humble roots:

It is a classic American tale: the immigrant’s son who made good.

Rodriguez grew up in a working-class neighborhood in Los Angeles. His father, Joseph, was a Mexican immigrant who plated jewelry for a living (the family’s otherwise modest house had gold-plated doorknobs). Though neither the mother nor the father, now both deceased, went to college, they taught Rodriguez and his older brother, Dick, about history and ethics. Joseph used to carry a copy of the Constitution in his pocket and would quiz his sons on it.

Joseph refused to teach the boys Spanish. “He was adamant that we be Americans,” Rodriguez says. “He did not want my brother or me to grow up with an accent. It was not a good time to be of Mexican or Spanish heritage.” Rodriguez’s father proudly hung his certificate of U.S. citizenship in a “place of honor” in the family’s den.

Rodriguez was an obsessive boy, especially when it came to money. He began collecting coins at age 6. He would memorize which vintages of pennies, nickels, and dimes were most valuable, and then convince gas station managers to trade with him. (He also collected stamps and insisted that his friends use tweezers if they wanted to pick them up.) When Rodriguez received a school assignment to write a letter to an important person at age 10, he chose the chairman of the Federal Reserve. He was even a (very) small-time banker: Rodriguez slowly accumulated savings, then lent money to his high-school-age brother — at usurious rates — when Dick needed cash to go on dates.

When Rodriguez was 12, he had a major operation on his teeth that, for two years, left him with a heavy speech impediment. Classmates teased him — so he gave a speech on the topic of elocution to show that he could make fun of himself. “Most people, when they’re different, they become self-conscious,” says Dick. “Bob hasn’t been one to sacrifice his ethics or his intellect to fit in.”

Los Angeles in the 1950s could be a hostile place for an immigrant’s son. Rodriguez recalls riding his bike past NO MEXICANS signs. And when the self-described B+ student told his high school guidance counselor that he wanted to go to college, he says, the counselor said he would be a better fit for trade school. “I told him to go to hell,” he bristles.

Rodriguez worked his way through college and business school at the University of Southern California. He sold encyclopedias door-to-door and toiled nights as a file clerk at Transamerica, where he met his future wife. (“I let him walk me to my car,” she says, “and I thought to myself, ‘Is this guy ever going to shut up?'”)

After getting his MBA, he struggled to find a job in finance before eventually becoming a stock trader at Transamerica. He then worked himself up to analyst by taking over sectors, such as forest products, that colleagues dropped. Says Rodriguez’s FPA colleague, Steven Romick: “There weren’t any ‘ez’ last names at the firms.” He adds, “Bob has always had to prove himself, again and again.”

Even today, Rodriguez is one of only a handful of Hispanic mutual fund managers in the country. A fervent believer in the power of the individual, Rodriguez downplays the effect of discrimination in his own life. Still, his thinking is revealing: He says he fell in love with investing in the first place (as opposed to architecture, another early interest) because it was a field where success isn’t based on subjective opinions. “I said, ‘Gee, there’s an exam every day. And whether you’re good or bad is independent of somebody else,’ ” he says. “If they say, ‘That’s a lousy idea,’ and it works out, that’s not their judgment — the market has judged.”

Rodriguez’s formative investing experience occurred during the stock bubble of the early 1970s. Like many at the time, he says, he thought anyone who posted annual returns of less than 25% was an idiot. Then the market crashed in 1974. Rodriguez owned shares of an RV maker called Executive Industries, whose stock plunged from $22 to less than a dollar. Unsure of what to do, he ventured into the USC library, where he discovered a book that would forever change his investing outlook: Graham and Dodd’s Security Analysis. “It helped me understand what was going on with the stock,” he says. “It was selling at less than 50% of the cash on the balance sheet.” His calculation of the company’s fundamental value convinced him that Executive Industries’ share price was baseless. He held on and eventually rode it back above $22. From then on, he was a committed value investor.

In 1983 Rodriguez joined First Pacific Advisors, then a burgeoning money-management firm with $1.6 billion in assets, and launched FPA Capital, a stock fund, and FPA New Income, a bond fund. His approach has been the same ever since. In his equity fund he maintains a highly concentrated portfolio of about 30 stocks and holds them for many years, buying and selling on dips and bumps. He spends months researching before taking the plunge; when he was thinking about buying more shares of Michaels, the craft-supply chain, in the ’90s, he called dozens of store managers to find out whether the company’s turnaround strategy was feasible. (It was: He bought shares in 1996 and watched them triple.)

By the mid-’90s, Rodriguez had achieved one of his goals as a fund manager: His stock fund had finished in the top 10 of its category over the previous decade (his bond fund ranked 11th). His other objective? “I said, I have a simple goal,” he recalls, laughing. “I just want to be the best goddamn money manager in the country.”

I’d definitely enjoy meeting him someday!

Low Cost Index Funds for 401(k)’s

Posted on | June 3, 2011 | No Comments

I’m generally pleased with my 401k, but I feel there is some room for improvement. I do get company matching but it is only 3% which seems to be a defacto standard. I think my employer could do at least a little bit more. My main concerns are investment options and fees. Ron Lieber wrote an article in the New York Times titled “Why 401(k)’s Should Offer Index Funds” arguing for inclusion of low cost Index Funds in all 401ks.

I am currently contributing to a S&P 500 index and a small cap index fund. Additionally, I have three additional mutual funds. So it seems i’m paying to have a team of analysts to try to beat the indices. The odds of them succeeding are stacked against them though.

For the 20-year period that ended in December, 72 percent of actively managed mutual funds that invest in United States stocks (including those that closed during that time period) did worse than their benchmark index. In United States bond funds, the figure was 81 percent. International stock mutual funds showed similar results over a 15-year period.

The writer also indicates that the fees charged by mutual funds compensate for the cost associated with operating the 401k . I would expect that the 401k provider would still be able to make money anyway.

I also came across an article that indicated that The Charles Schwab is planning to offer low cost ETFs in a 401k. They won’t be available until next year. I’d definitely like to have the additional options to choose from.

One thing to keep in mind though is that Index funds and ETFs do well when the whole market is in sync going up or down. During 2009/2010 it didn’t matter what stock you owned the whole market was in a recovery mode. That would have been a great time to own the broad indices. Now that the market has recovered it seems that more active management might have the advantage. Again, though, I’d rather have the lower fees with the market average returns.

I think I’ll start lobbying to get our 401k changed over to Schwab.

What investment returns should you expect?

Posted on | February 7, 2011 | No Comments

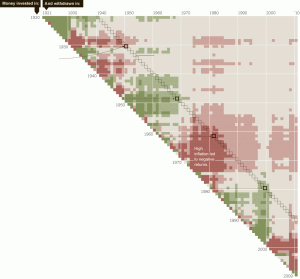

The graphic below was published in the New York Times a few weeks ago. It contains the annualized returns for the S.& P. 500., for nearly 4,000 periods.

It was created by Ed Easterling, who runs an investment management and research firm from Corvallis, Oregon. It was a response to the question: “…whether investors should expect to achieve long-term average returns in the future.” You can read the full article here.

Unfortunately (for me), I really only started investing right around the year 2000 — what an awful time to start investing in stocks! I was too late to take advantage of the dot com craze in the 1990’s and instead saw my 401k drop in value during the ensuing bust. I’ve been able to take advantage of the stock market drop between 2007 – 2009 to make up for my losses. I hope the next 10 years are better than the last 10.

I think the lesson here is to keep a reasonable amount of cash available for investing when the stock market falls dramatically.

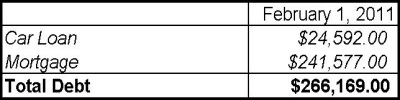

February 2011 Total Debt

Posted on | February 4, 2011 | No Comments

I’ve included my total debt as of February 1, 2011 below. I won’t be including my credit card balance moving forward. I’m fortunate enough to be able to pay off the balance in full every month. As an added bonus, I’m also receiving 2% cash back on purchases.

My primary focus is on paying down my car loan and mortgage ahead of schedule. In January, I was able to pay down the principal on my loans by a total of $1137 (car loan by $763 and mortgage by $374).

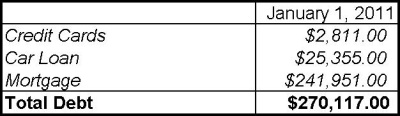

January 2011 Total Debt

Posted on | January 6, 2011 | No Comments

I’ve included my total debt as of January 01, 2011. I will provide additional details in future posts. At this time, I just wanted to create a baseline to use moving forward. My goal this year is to reduce my debt by $15,000.